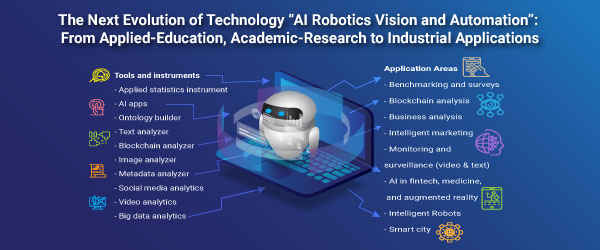

APPLIED STATISTICS AND INSTRUMENTS

We research the statistical models to improve the accurate rates of the measurement. We develop statistical instruments and tools with our research outputs for industrial brenchmarking, investment tradings, market researches, data analysis, optimization, prediction, and forecasting in finance, actuarial science, logistic management, business, and medicine areas.

We do consutlancy in the area of biostatistics, market survey, consumer behavioral analysis, business forecasting, operations optimization, risk analysis, marketing strategies, algo tradings, medical researches, and etc.

WANG, A., LIU, Z.H. (2022) A Two-Sample Robust Bayesian Mendelian Randomization Method Accounting for Linkage Disequilibrium and Idiosyncratic Pleiotropy with Applications to the COVID-19 Outcome Genetic Epidemiology. doi: 10.1101/2021.03.02.21252801

QU, Y.K., LEE, C.Y. and LAM, K.F. (2021). A sequential test to compare the real-time fatality rates of a disease among multiple groups with an application to COVID-19 data. Statistical Methods in Medical Research. doi: 10.1177/09622802211061927

JIN, H.Q., YIN, G. (2021). Unit information prior for adaptive information borrowing from multiple historical datasets. Statistics in Medicine. 40, Issue25, 5657-5672.

ZHANG, C.Y., JIN, H.Q., WEN, Y.F. and YIN, G. (2021). Efficacy of COVID-19 Treatments: A Bayesian Network Meta-Analysis of Randomized Controlled Trials. Frontiers in Public Health. 9. doi: 10.3389/fpubh.2021.729559.

ZHANG, C.Y., YIN, G. (2021) Reduction in number to treat versus number needed to treat BMC Medical Research Methodology. 21. doi:10.1186/s12874-021-01246-5

LIU, W., GUO, Y.S. and LIU, Z.H. (2021) An Omnibus Test for Detecting Multiple Phenotype Associations Based on GWAS Summary Level Data Frontiers in Genetics. 12. doi:10.3389/fgene.2021.644419

YIN, G., ZHANG, C.Y. and JIN, H.Q. (2020) Statistical Issues and Lessons Learned From COVID-19 Clinical Trials With Lopinavir-Ritonavir and Remdesivir JMIR Public Health and Surveillance. 6(3), e19538. doi:10.2196/19538

ZHANG, C.Y., WU, Y.S. and YIN, G. (2020) Restricted mean survival time for interval‐censored data Statistics in Medicine. 39, Issue26, 3879-3895. doi:10.1002/sim.8699

YIN, G., ZHANG, C.Y. and YANG, Z.B. (2019) Biostatistics pitfalls: Lessons learned from analysis of medical data Contemporary Clinical Trials. 87, 105875. doi: 10.1016/j.cct.2019.105875

ZHOU, J.Y., YOU, X.P., YANG, R. and FUNG, W.K. (2018) Detection of imprinting effects for qualitative traits on X chromosome based on nuclear families. Statistical Methods in Medical Research, 27(8), 2329-2343.

SHI, H. and YIN, G. (2017). Landmark cure rate models with time-dependent covariates. Statistical Methods in Medical Research, 26(5), 2042-2054.

WU, D., LAM, T., LAM, K.F., ZHOU, X.D. and SUN, K.S. (2017). Health reforms in China: the public’s choices for first-contact care in urban areas. Journal of Family Practice, 34(2), 194-200.

WU, D., LAM, T., LAM, K.F., ZHOU, X.D. and SUN, K.S. (2017). Challenges to healthcare reform in China: profit-oriented medical practices, patients' choice of care and guanxi culture in Zhejiang province. Journal of Health Policy and Planning, 32(9), 1241-1247.

LAM, T.P., MAK, K.Y., LAM, K.F., CHAN, H.Y. and SUN, K.S. (2016). Five-year outcomes of western mental health training for Traditional Chinese Medicine Practitioners. Journal of BMC Psychiatry, 16(1), 363.

QIN, G., ZHANG J., ZHU, Z.Y. and FUNG, W.K. (2016). Robust estimation of partially linear models for longitudinal data with dropouts and measurement error. Statistics in Medicine, 35, 5401-5416.

LIN, R.T. and YIN, G. (2013). Nonparametric overdose control with late-onset toxicity in phase I clinical trials. Biostatistics, 18(1), 180-194.

YIN, G. (2012). Clinical Trial Design: Bayesian and Frequentist Adaptive Methods. John Wiley & Sons.

CHUNG, Y.K., HU, Y.Q. and FUNG, W.K. (2010). Evaluation of DNA mixtures from database search. Biometrics, 66, 233-238.

HAN, X., LIANG, Z. and YUEN, K.C. (2018). Optimal proportional reinsurance to minimize the probability of drawdown under thinning-dependence structure. Scandinavian Actuarial Journal, 45(1), 207-238.

CHEUNG, K.C. and LO, A. (2017). Characterizations of optimal reinsurance treaties: a cost-benefit approach. Scandinavian Actuarial Journal, 1, 1-28.

CHEUNG, K.C., CHONG, W.F. and Yam, S.C.P. (2015). The optimal insurance under disappointment theories. Insurance: Mathematics and Economics, 64, 77-90.

CHEUNG, K.C., CHONG, W.F. and YAM, S.C.P. (2015). Convex ordering for insurance preferences. Insurance: Mathematics and Economics, 64, 409-416.

ZHOU, M. and YUEN, K.C. (2015). Portfolio selection by minimizing the present value of capital injection costs. ASTIN Bulletin, 2018(10), 863-889.

BENSOUSSAN, A., SIU, C. C., YAM, S.C.P. and YANG, H. (2014). A class of non-zero-sum stochastic differential investment and reinsurance games. Automatica, 50, 2025-2037.

GERBER, H. U., SHIU, E.S.W. and YANG, H. (2013). Valuing equity-linked death benefits in jump diffusion models. Insurance: Mathematics and Economics, 53(3), 615-623.

GERBER, H. U., SHIU, E.S.W. and YANG, H. (2012). Valuing equity-linked death benefits and other contingent options: A Discounted Density Approach. Insurance: Mathematics and Economics, 51(1), 73-92.

YUEN, K.C., WANG, G. and LI, W.K. (2007). The Gerber-Shiu expected discounted penalty function for risk processes with interest and a constant dividend barrier. Insurance: Mathematics and Economics, 40(1), 104-112.

YUEN, K.C., SHI, J. and ZHU, L. (2006). A k-sample test with interval-censored data. Biometrika, 93(2), 315-328.

HAN, Y.L., et al. (2019). Shrinkage estimation of Kelly portfolios. Quantitative Finance. 19(2), 277-287.

LAW, K.F., et al. (2018). A single-stage approach for cointegration-based pairs trading. Finance Research Letters. 26(Sep), 177-184.

XIN, L., et al. (2017). Pricing an accumulator with continuous or discrete barrier. Journal of Derivatives, 24(4), 93-107.

WANG, F., et al. (2014) Combining technical trading rules using particle swarm optimization. Expert Systems with Applications, 41(6), 2016-2026.

WANG, F., et al. (2014). Combining Technical Trading Rules Using Parallel Particle Swarm Optimization based on Hadoop. In Proceedings of IEEE WCCI2014, 3987-3994.

XIN, L., et al. (2013). An application of CUSUM chart on financial trading. In Proceedings of the 9th International Conference on Computational Intelligence and Security (CIS), IEEE, 178-181.

CHENG, X.X., et al. (2011). Basket trading under co-integration with the logistic mixture autoregressive model. Quantitative Finance, 11, 1407-1419.

KWAN, Josephine WC, et al. (2000). Forecasting and trading strategies based on a price trend model. Journal of Forecasting. 19, 485-498.